Channels lising page

All videos archived of Logically Answered

1JVtUkrWqtw | 20 Feb 2026

Get started with Claude Code on the Max plan ➡️ http://clau.de/LogicallyAnswered You’ve probably seen the headlines. Zuckerberg is finally pulling back from the Metaverse. After nearly $70 billion poured into Reality Labs, thousands of layoffs, and entire VR products getting shut down, the “new internet” suddenly looks more like a very expensive experiment. Horizon Workrooms is gone. Horizon Worlds is being scaled back. Reported active users never came close to Meta’s targets. Reality Labs lost over $17 billion in a single year while bringing in a fraction of that in revenue. Investors watched the stock crater while Zuckerberg, holding majority voting power, kept doubling down. The bigger issue was not just the money. It was adoption. VR headset shipments declined even as Meta owned most of the market. They were dominating a tiny, shrinking island. Meanwhile, platforms like Fortnite, Roblox, and VRChat quietly built social worlds people actually used. Now Meta is pivoting. Less bulky headsets, more AI wearables. Ray Ban smart glasses with built in cameras and assistants. Over a million sold, with bigger targets ahead. It is a far better form factor, but it is still the same ambition. Own the next platform. So has Zuckerberg learned from the Metaverse collapse, or is this just the same obsession with a new coat of paint? LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - $70 Billion Disaster 0:24 - Giving Up 2:13 - Claude Code Sponsorship 5:17 - Zuck’s New Internet 11:51 - Same Obsession, New Bet Resources: https://pastebin.com/4SUqbDM4 Disclosure: This video is sponsored by Anthropic. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

yYe9YrdyJNQ | 13 Feb 2026

Check out Cape and use code LOGICALLY33 to get 33% off your first six months ➡️ https://www.cape.co/?utm_source=creators&utm_platform=youtube&utm_campaign=logicallyanswered You’ve probably seen the headlines. OpenAI launches Sora 2, calls it the future of video… and within 30 days, retention drops to 1 percent. At the same time, Microsoft reports strong earnings, beats revenue expectations at 81 billion dollars, and still loses 360 billion dollars in market cap in a single day. Why? Because capital spending jumped 66 percent, with tens of billions flowing straight into AI chips. Nvidia walks back massive OpenAI investment plans. Oracle announces a 50 billion dollar AI push and its stock falls. OpenAI reportedly projects negative 143 billion dollars in cash flow before turning profitable. Even politicians on both sides signal there will be no bailout if things go wrong. Search interest in AI has peaked. Products like. Sora and Suno exploded at launch, then lost nearly all their users. The hype cycle is real. Tourists show up, generate a few images or videos, then leave. Meanwhile, only about 3 percent of Microsoft’s 365 users pay for Copilot. CEOs say they see little measurable return. With hundreds of billions invested, AI cannot survive as a niche toy. So what is this? A bubble bursting, or the painful shift from inflated expectations to practical use? The future of AI may not be world domination. It may be quiet productivity inside tools we already use. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - The Sora Disaster 0:40 - Inflated Expectations 5:25 - Trough of Disillusionment 11:32 - Plateau of Productivity Resources: https://pastebin.com/Xw462YzP Disclosure: This video is sponsored by Cape. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

7UblPpm-52E | 06 Feb 2026

OneDrive is everywhere. It ships with Windows, lives inside File Explorer, and constantly asks to back up your files. And yet most people ignore it, uninstall it, or close the popup and go straight to Google Drive. That’s the weird part. On paper, OneDrive looks like the better product. It is deeply integrated into Windows, often bundled with Microsoft 365, and packed with features that Google Drive either lacks or only recently added. Faster uploads, tight OS level backups, and powerful recovery tools that can roll back your entire drive after corruption or ransomware. So why does it still lose. This video breaks down the OneDrive paradox. How Microsoft built a genuinely strong cloud storage product, then managed to annoy users into avoiding it. How Google quietly won by locking in students early through schools, Chromebooks, and Docs. And how habit, switching costs, and ecosystem gravity matter more than raw features. We also look at the trust problem. Storage cuts, removed features, forced prompts, and changes that made users feel burned over time. OneDrive did a lot right. It just did enough wrong to push people away. If OneDrive seems better but still feels worse to use, this explains why. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - OneDrive 0:39 - The OneDrive Paradox 4:08 - Google’s Early Edge 8:00 - Lost Trust Resources: https://pastebin.com/GgzAqgX0

T2FRU7LGb7g | 02 Feb 2026

Build your e‑commerce store in minutes: https://hostinger.com/logicallyanswered. Use code LOGICALLYANSWERED for extra 10% off In January 2025, UPS announced it would cut Amazon shipping volume in half. The stock dropped fast and headlines said the company was in trouble. But the reaction missed the point. This move was not a panic decision. It was the end of a strategy UPS started years earlier. Back in 2021, leadership quietly began reducing Amazon volume, even while ecommerce kept growing. Amazon stayed a large customer, but it was never a great one. Lots of small residential deliveries. High labor. High last mile costs. Thin margins. By 2025, Amazon made up a huge share of packages but a much smaller share of revenue. Cutting that volume meant fewer trucks, fewer facilities, and fewer workers tied to low margin routes. Costs dropped fast. Revenue fell too, but profit per package went up. Operating margins improved even as total revenue declined. UPS was choosing better packages instead of more packages. This is not new. FedEx walked away from Amazon years earlier and later returned only for large profitable deliveries. Amazon has also become its own shipping giant, controlling more of the network each year and squeezing carriers on price. That shift forced UPS to adapt or get trapped in low margin work. The result is a bigger lesson. In logistics, scale alone does not win. Margins matter more than volume. Sometimes firing your biggest customer is the only way to stay in control. Timestamps: 0:00 - UPS Cuts Amazon 0:36 - Cutting Your Biggest Customer 3:27 - Better Packages 8:27 - The Changing Game Resources: https://pastebin.com/U3WDFLft Disclosure: This video is sponsored by Hostinger. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

15A1LHhYcuE | 30 Jan 2026

Stop torturing yourself and get Opera GX: https://operagx.gg/LogicallyAnswered. Sponsored by Opera GX! DirecTV was once the biggest TV provider in America. Nearly every rural home had a satellite dish on the roof, sports bars ran Sunday Ticket on every screen, and the company sat at almost 25 million subscribers. It looked unstoppable. But behind the scenes, the cracks were already forming. This video breaks down how DirecTV rose to dominate pay TV, why satellite once beat cable for millions of households, and how one exclusive sports deal became its crown jewel. Then everything started to shift. Streaming made TV simpler, cheaper, and instant. At the same time, DirecTV was dealing with a far bigger problem than Netflix. The real turning point came when AT&T stepped in. A massive acquisition, aggressive price hikes, confusing rebrands, and a streaming product that undercut its own core business slowly pushed loyal customers away. Subscriber losses piled up, employees grew frustrated, and trust eroded. By the time DirecTV lost the NFL, the damage was done. What followed was cost cutting, desperate monetization, and one of the strangest pivots in modern TV history, turning idle screens into AI driven ad space using customer data. This is the story of how a dominant media giant collapsed, not because technology moved on, but because the company ignored the people who made it successful in the first place. Timestamps: 0:00 - The State Of DirecTV 0:26 - The Golden Age of TV 2:45 - A Controlling Parent 9:59 - Cutting Losses Resources: https://pastebin.com/RK1z0qse Disclosure: This video is sponsored by Opera GX. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

r8J0a-A0em4 | 19 Jan 2026

Thanks to Storyblocks for sponsoring this video! Download unlimited stock media at one set price with Storyblocks http://storyblocks.com/LogicallyAnswered In the early 2010s, Samsung pulled off something no one thought was possible. They beat Apple at its own game. At their peak, Samsung controlled over 30 percent of the global smartphone market and became the clear king of Android by doing the exact opposite of Apple. More freedom. More features. More control for users. But that identity didn’t last. This video breaks down how Samsung won by being the anti Apple, and how trying to become Apple slowly unraveled everything that made them successful. From removable batteries and expandable storage to mocking Apple for removing the headphone jack, Samsung built its reputation on user choice. And it worked. By 2013, they had overtaken Apple globally, selling nearly twice as many phones. Then the priorities shifted. Chasing Apple’s profit margins, Samsung began removing the very features their fans loved. Sealed batteries. No microSD cards. Fewer accessories in the box. Even the headphone jack eventually disappeared. What followed was an identity crisis. Samsung phones became more restrictive, but without Apple’s ecosystem, polish, or brand moat. As competition exploded across Android and cheaper phones got better, Samsung lost its edge. This is the story of how copying Apple turned Samsung from the obvious Android choice into just another option, and why that decision cost them their crown. Timestamps: 0:00 - The State Of Samsung 0:32 - The Anti-Apple 4:26 - The Second Apple 9:57 - The Fall Resources: https://pastebin.com/JkurkeWg

T4DeiIlhzUU | 05 Jan 2026

Ecommerce was supposed to replace retail entirely. No stores, no salespeople, no middlemen. Just brands selling directly to you online. For a while, it worked. DTC brands like Warby Parker, Allbirds, Casper, Glossier, and Skims raised billions, scaled fast, and helped push old school retail into a full blown collapse. Malls emptied out, big chains went bankrupt, and online shopping looked unstoppable. Then something strange happened. Ecommerce growth slowed. Customer acquisition got expensive. Return rates exploded. And the same online only brands that once bragged about having zero stores started opening them anyway. This video breaks down how the DTC dream took over the 2010s, why it started cracking, and what ecommerce quietly failed to solve. It looks at rising ad costs, bracketing, trust issues, and why seeing products in person still matters more than we like to admit. It also explains why Gen Z, the most online generation ever, actually prefers shopping in stores and how that shift is reshaping malls into experience driven spaces instead of pure shopping hubs. Retail did not die. It adapted. And now, the future of shopping looks a lot more hybrid than anyone expected. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - The E-commerce Fantasy 0:40 - The DTC Dream 5:10 - When Growth Gets Expensive 9:40 - The Retail Rebound Resources: https://pastebin.com/TfErupnu

L2K0bblsdlk | 02 Jan 2026

Check out Cape and use code LOGICALLY33 to get 33% off your first six months https://www.cape.co/?utm_source=creators&utm_platform=youtube&utm_campaign=logicallyanswered By now it feels like every review you read is suspect. Google Maps, Amazon, Yelp, the places we rely on most are flooded with fake praise and fake outrage. What started as a shady side hustle quietly turned into a billion dollar industry, and AI only poured gasoline on it. This video dives into how reviews became so powerful in the first place, why businesses learned to game them, and how platforms made it surprisingly easy to fake credibility. From Google Local Guides to Amazon review abuse, you will see how fake feedback spreads, why small businesses get stuck with it, and why the clean up process is so broken. Then things get darker. Modern AI can generate endless believable reviews that sound personal, specific, and real. The problem is no longer volume, it is realism. Platforms are fighting back with their own AI, but it has become an arms race where scammers constantly adapt. From there, the story zooms out into something bigger. Fake reviews are just one symptom of a wider shift where bots, AI accounts, and synthetic engagement dominate huge parts of the internet. Likes, comments, traffic, even opinions are increasingly manufactured. The question is no longer which reviews are real, but how much of what we see online is human at all. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Fake Reviews 0:19 - The World Of Fake Reviews 5:37 - Enter AI 10:41 - The Dead Internet Resources: https://pastebin.com/RmXBDha4 Disclosure: This video is sponsored by Cape. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

e0GrFKFtOK0 | 26 Dec 2025

Check out Coursera and get 40% off for 3 months using my link 👉🏻 https://imp.i384100.net/c/6730596/3719965/14726 In late 2025, Disney quietly doubled the annual price of Disney Plus from $79 to $159. People were furious. Subscriber counts had already been slipping, the stock had gone nowhere for a decade, and then executives dropped an even stranger line after Andor succeeded: “streaming is dead.” So what actually happened? This video breaks down what Disney Plus was supposed to be, why it exploded out of the gate, and why that early momentum completely stalled. Disney entered streaming with an unmatched pile of IP, Pixar, Marvel, Star Wars, Fox, and even Hotstar, and for a moment it looked unstoppable. Tens of millions signed up in months, Netflix stumbled, and the industry panicked. But hype fades. Netflix kept growing while Disney Plus plateaued. Originals got more expensive, churn skyrocketed, and despite billions of minutes watched, Disney’s streaming business lost billions of dollars. Netflix, somehow, stayed profitable. The turning point came when streaming companies stopped chasing scale and started chasing profit. Password crackdowns, price hikes, content pullbacks, and strategic subscriber losses changed the game. Disney followed the same playbook, and for the first time, Disney Plus started making real money. This is the story of why Disney Plus is not dying, why streaming “failed,” and how losing subscribers became the smartest move Disney ever made. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Disney+ Price Hike 0:36 - The Sleeping Giant 4:30 - Waning Hype 9:39 - Strategic Churning Resources: https://pastebin.com/RwBT5fr0 Disclosure: This video is sponsored by Coursera. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

YvGS-efW2ZU | 12 Dec 2025

Learn faster and retain more with Recall - be among the first to experience their latest release of the AI notetaker and use code logic25 to get 25% off ➡️ https://www.getrecall.ai/?t=logic Dell used to stand for power and reliability. If you bought an XPS, you knew exactly what you were getting. Strong performance, practical design, and something you could actually rely on day to day. But somewhere along the way, that identity started to blur. This video breaks down how Dell slowly lost its way by chasing Apple’s design philosophy, and how that decision quietly gutted one of its most beloved product lines. The XPS started as an “Extreme Performance System” all the way back in the 90s, built around raw capability rather than looks. Over time, especially after the XPS relaunch and the introduction of the XPS 13 Plus, priorities shifted. Ultra thin designs, touch bars, missing ports, and questionable design choices started to pile up. On paper, these machines looked insane. Powerful CPUs, high resolution OLED displays, even dedicated GPUs. In real world use, though, things fell apart. Thermal throttling, loud fans, terrible battery life, and reliability issues turned what should have been premium laptops into frustrating daily drivers. As Dell doubled down with newer XPS models and eventually a full rebrand, the problems didn’t really go away. Instead, the XPS name disappeared entirely. This is the story of how chasing sleekness over execution cost Dell its reputation in the premium laptop space, and why copying Apple without matching the fundamentals rarely ends well. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Dell XPS 0:30 - The Pivot 4:58 - Bad To Worse 11:37 - The Rebrand Resources: https://pastebin.com/GZs7A9VH Disclosure: This video is sponsored by Recall. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

pwgAyXH692w | 08 Dec 2025

BMW tried to turn a hundred thousand dollar car into a monthly payment machine. Heated seats were already in the car, wired up and ready, but BMW locked them behind a subscription. Eighteen bucks a month to warm a seat you already paid for. They called it flexibility. Everyone else called it paying twice. The outrage hit fast, memes blew up, and BMW became the face of a growing fear in the car world. A future where every feature is hidden behind some pointless paywall. Other automakers were doing the same thing, but BMW took the hit because it crossed a line. People will tolerate subscriptions when they feel like real services that cost money to run. Data plans, maps, cloud features. BMW tried to charge recurring revenue for hardware with almost zero cost and it tanked. Adoption was terrible, their stock dipped, and they quietly killed the idea. The whole thing shows a simple truth. People hate feeling squeezed, especially in a luxury car. And once trust breaks, it takes a lot more than warm seats to fix it. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - BMW Gets Greedy 0:38 - Adding “Choice” 3:42 - Double-Charging 7:14 - Services vs. Paywalls Resources: https://pastebin.com/WNg65C3s

v4lxB6lZN04 | 05 Dec 2025

PayPal looks fine on paper, but the story behind the scenes is rough. The company that used to make online shopping simple is now bleeding users and squeezing the ones who stay. For years, the yellow button sat on every checkout page and felt like the safest way to pay. They handled cards, currency conversions, fraud checks, transfers, even Venmo and donations. They became part of the internet itself. But once they hit that level of dominance, the experience slipped. Fees stacked up everywhere, service got worse, and customers started calling out locked accounts, missing funds, and support that goes nowhere. Merchants deal with high processing rates and long holds on their money. Regular users deal with instant withdrawal fees and hidden conversion markups. Then came the policy fiascos that made people question how much control PayPal should have over anyone’s money. Now competitors like Wise, Payoneer, Apple Pay, and Google Pay are faster, cheaper, and already inside your phone. PayPal is still huge, but the cracks are real, and for the first time ever, people are walking away. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - PayPal 0:27 - The Ubiquity Tax 5:14 - The Heavy Hand 8:59 - Besieged On Every Front Resources: https://pastebin.com/yCsvWEaQ

9IBUf7_h_SM | 01 Dec 2025

InvestingPro at the lowest price: 60% + 15% using my coupon code "logicallyanswered" or click here https://www.investing-referral.com/logicallyanswered/ Limited time only, don’t miss out!!! Ferrari built its entire identity on scarcity. Waiting lists, strict rules, even banning celebrities if they broke them. It was all part of the game that turned a car into a status signal. For decades it worked. Demand always beat supply, values stayed high, and owning a Ferrari actually meant something. Then a new CEO came in with a plan to modernize and scale. More models, new segments, even an SUV, and an aggressive push toward hybrids and EVs. The numbers looked great at first. Shipments hit record highs, revenue soared, and Ferrari seemed unstoppable. But the cracks are showing. The new EV lineup stalled, demand softened, and the once rock solid secondary market started slipping. Fans who used to fight for allocation are hesitating now. Cars that once held value are depreciating faster than anyone expected, even the Purosangue. Ferrari is trying to slow sales again to protect the brand, but investors want the opposite. It feels like the company is stuck between growth and exclusivity, and the balance that made Ferrari untouchable might be slipping away. Timestamps: 0:00 - Ferrari’s Identity Crisis 0:36 - Scarcity 7:33 - New Markets 11:30 - Depreciation Resources: https://pastebin.com/gWEikGvK Disclosure: This video is sponsored by Investing.com. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

CEue-CvyRoA | 10 Nov 2025

Check out Cape and use code LOGICALLY33 to get 33% off your first six months ➡️ https://www.cape.co/?utm_source=creators&utm_platform=youtube&utm_campaign=logicallyanswered Duolingo used to be the internet’s favorite app. That green owl made learning fun, viral, and weirdly addictive. Everyone knew Duolingo for its streaks, its chaos, and its brilliant marketing. But lately, something’s changed. Duolingo went “AI First,” and things started breaking. Courses felt worse, translations got messy, and users started noticing the drop in quality. Then came layoffs, confusion, and even legal investigations into whether Duolingo misled investors about growth. The company that built its brand on personality and habit suddenly felt hollow. Duolingo used to feel human — now it feels robotic. The shift from quirky and fun to cold and corporate has left users questioning what happened to the app they loved. It’s a wild fall for a company that once turned language learning into a global movement. And the way Duolingo handled its AI obsession might just be a warning for every tech company chasing the same path. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Duolingo 0:38 - The Rise Of Duo 4:18 - The First Cracks 10:52 - Fraud Resources: https://pastebin.com/Dm0HB1rr Disclosure: This video is sponsored by Cape. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

ZG1yJSm83Jw | 07 Nov 2025

For years, AMD was seen as the runner-up. NVIDIA owned the AI GPU market with a 94% share, while AMD barely held on with six percent. NVIDIA’s CUDA software ecosystem made them untouchable, and for a long time, AMD couldn’t compete. But everything just changed. OpenAI has officially signed a massive deal with AMD—potentially worth $100 billion. It’s not just about chips anymore, but the future of AI hardware. AMD’s Instinct MI300X already beats NVIDIA’s H100 in certain workloads, and the upcoming MI450 series was designed with direct input from OpenAI engineers. In exchange, OpenAI could receive up to 10% of AMD’s stock if performance milestones are hit. It’s a risky move, but it might finally break NVIDIA’s monopoly. After years of being an afterthought, AMD is suddenly at the center of the AI race. Whether this gamble pays off will decide who powers the next generation of artificial intelligence. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - The State Of AMD 0:30 - The Moat 5:10 - The Fight To Catch Up 9:08 - The 10 Percent Bet Resources: https://pastebin.com/jW4Zuqs5

lD4QKP4M6-s | 04 Nov 2025

Plaud Website → https://bit.ly/3JD5AYT 📣 10% off Code: LA10 Amazon link → https://amzn.to/4hy28LV In February 2025, Nissan’s CEO Makoto Uchida met with Honda’s president to discuss a historic merger that could’ve saved Nissan. But instead, Uchida backed out. A month later, he resigned, and Nissan’s future fell apart. It wasn’t always like this. Back in the late 90s, Carlos Ghosn had saved Nissan from bankruptcy, transforming it into a global powerhouse alongside Renault and Mitsubishi. But years later, scandals, bad bets, and pride would undo everything. When Ghosn fled Japan after being charged with financial misconduct, Nissan lost its direction. Uchida tried to rebuild through “Nissan NEXT,” slashing costs and aiming for a comeback. For a while, it worked — profits returned, and Nissan looked stable again. But they missed one crucial shift: hybrids. While Toyota doubled down, Nissan ignored them, betting entirely on EVs. Now they’re buried under $50 billion in debt, with massive layoffs and collapsing sales. The Honda deal could’ve been their lifeline. Instead, pride might’ve sealed Nissan’s fate. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Refusing The Bailout 0:48 - Hero To Villain 6:01 - Bouncing Back 12:48 - The Merger Resources: https://pastebin.com/ND00ZKFY Disclosure: This video is sponsored by Plaud. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

m_LCI2rFDUY | 31 Oct 2025

💡 Turn any idea into a production-ready app or website by describing it to AI. Dream it, and Lindy builds it from coding to QA. Try Lindy today using my link 👉🏻 https://go.lindy.ai/logically-answered In the early 2010s, OLED was a joke. Too fragile, too expensive, and impossible to scale. Everyone dropped it except LG. Fast forward to today, and LG owns over half the global OLED market. They even make panels for Samsung and Sony. So what did LG see that everyone else missed? Back in the 2000s, the TV world was all Plasma and LCD. Plasma had the best picture but came with heat, power, and burn-in issues. LCDs were cheap, efficient, and “good enough.” While everyone chased scale, LG doubled down on quality. They bought Kodak’s OLED patents, poured billions into R&D, and invented WRGB OLED to cut costs. For years, it looked like financial suicide. But when Netflix, gaming, and home theaters exploded, OLED became the gold standard. By 2016, LG had perfected manufacturing, and by 2017, the C7 OLED changed everything. Competitors mocked OLED, then bought LG panels anyway. Now, LG Display supplies Samsung, Sony, and nearly every major brand. The bet no one believed in became the tech no one could live without. Timestamps: 0:00 - OLED 0:35 - All In 4:10 - Doubling Down 9:53 - The Empire Resources: https://pastebin.com/ywMnAEK0 Disclosure: This video is sponsored by Lindy. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

-OQsNAHPdzM | 27 Oct 2025

Reddit just pulled off the impossible: after nearly 20 years of losses, they’ve finally turned a profit. $89 million in a single quarter. And it’s all thanks to AI. Google and OpenAI are paying Reddit tens of millions to train their models, feeding them the internet’s biggest archive of human conversation. But here’s the twist—those same deals that saved Reddit might also destroy it. Because as AI gets better at answering questions, fewer people visit the site that trained it. Reddit’s data is valuable now, but once AI no longer needs it, what happens then? The irony is brutal: Reddit’s new revenue comes from the same technology that’s slowly replacing it. What started as a lifeline could turn into a trap, one that forces Reddit to depend on the very companies eating its traffic alive. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Reddit Turns Profitable 0:34 - Saving Grace 4:33 - Monetization 8:28 - Double-Edged Sword Resources: https://pastebin.com/5egBZaFc

riJFWFR0-LQ | 24 Oct 2025

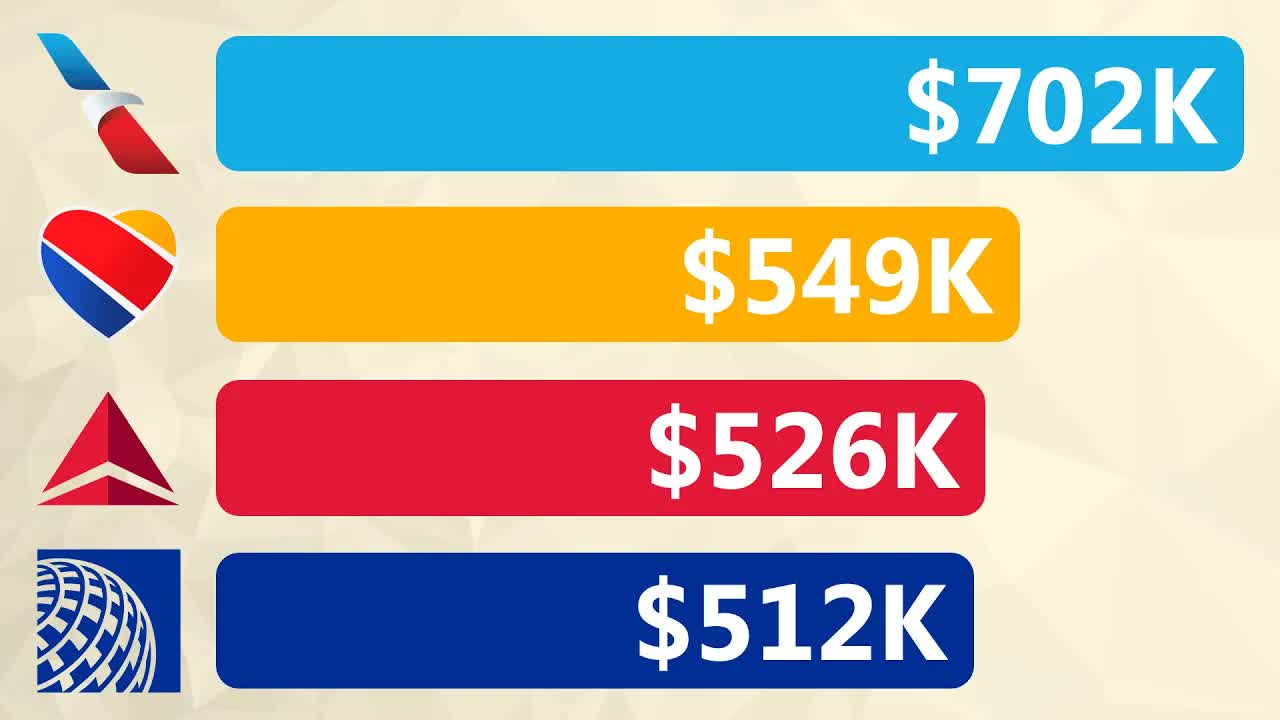

Flying used to feel exciting. Now it feels like extortion. Smaller seats, higher prices, endless fees, and no free bags. It’s not your imagination — flying has genuinely gotten worse. Airlines made $33 billion last year just from baggage fees, and the crazy part is that baggage was only the beginning. Seat selection, early boarding, legroom — every part of the experience has been monetized. But this didn’t happen overnight. Airlines have always been terrible businesses, running on razor-thin margins while battling expensive planes, volatile fuel prices, and debt. When the 2008 crisis hit, they got desperate. Instead of raising ticket prices, they just started moving the costs somewhere else. Then came smaller seats, fewer perks, and the rise of “pain point” pricing — making the cheapest seats unbearable so you’d pay more to escape misery. Even Southwest, the one airline that stood for fairness, finally gave in and started charging for bags. This video breaks down how air travel went from a symbol of freedom to a corporate trap. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - The State Of Airlines 0:35 - Fees Rising 4:36 - Seats Shrinking 8:53 - Anger Growing Resources: https://pastebin.com/YdgkVcek

45OzFb1ojJ0 | 20 Oct 2025

In July 2025, Porsche’s CEO Oliver Blume sent a memo that shocked employees: their iconic business model was breaking down. The company’s profits were collapsing, shares had fallen over 50%, and even diehard fans were furious. It’s hard to imagine how one of the most beloved car brands on earth ended up here. But to understand, we have to go back to the Taycan — Porsche’s first fully electric car. When it launched, it was hyped as the future: fast, beautiful, “soul electrified.” But beneath the surface, problems started stacking up. The cars were glitchy, expensive to fix, and losing value fast. Customers waited months for repairs. Porsche’s big EV dream had become a nightmare. Even worse, the company forgot what made it special. Sports cars aren’t just about numbers; they’re about emotion — the sound, the feel, the nostalgia. Porsche tried to out-Tesla Tesla, and it backfired. Now, facing falling profits and mass layoffs, Porsche is quietly shifting back to combustion engines. The electric dream wasn’t the problem; forgetting the heart was. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - A Porsche Crisis 0:36 - The Electric Dream 4:36 - Depreciation 9:00 - The Heart Resources: https://pastebin.com/EX3VYesC

vHPpBZiR80c | 17 Oct 2025

Something strange is happening in programming. Everyone’s talking about “vibe coding” — writing entire apps with AI instead of actually coding. It looks magical on TikTok and YouTube, but behind the scenes, it’s turning into a mess. AI-generated code is often bloated, buggy, insecure, and sometimes flat-out dangerous. It can leak passwords, make up fake functions, or skip basic safety checks entirely. And yet, big tech is doing it too. The deeper problem isn’t just bad code — it’s that no one’s really checking what the AI is spitting out. Developers are shipping software they barely understand, and the AIs building it don’t understand it either. Studies show AI-assisted coders produce more vulnerabilities, feel more confident, and fix fewer of them. Combine that with companies replacing junior devs with chatbots, and we’re setting up for a “lost generation” of engineers who can’t debug what they didn’t write. Maybe the real risk of AI isn’t sentient robots — it’s the quiet collapse of human understanding behind the code that runs everything. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps 0:00 - Vibe Coding 0:52 - Rise Of “Vibes” 3:26 - Artificial Hallucination 8:59 - Runaway Loops Resources: https://pastebin.com/DTwZPBEH

DvfFwXLjnC8 | 13 Oct 2025

Larry Ellison’s net worth just jumped a hundred billion dollars overnight. Yeah, billion with a “B.” It’s the biggest single-day jump in history and briefly made him the richest man alive. The weird thing? Oracle doesn’t even make AI models or chips. So why is OpenAI paying them $300 billion? Turns out, Oracle isn’t building AI, it’s powering it. They’re the ones providing the space, electricity, and computing muscle behind all those massive NVIDIA GPUs. Basically, the landlords of the AI boom. And because Ellison still owns 42% of Oracle, that $300 billion deal sent his net worth into orbit. But here’s the twist: it’s not $300 billion in cash. It’s future revenue spread out over years, with a ton of risk attached. Still, it shows how fast the AI arms race is expanding. Ellison once mocked cloud computing as “gibberish,” then quietly rebuilt Oracle around it — and that bet is finally paying off. Now, as companies burn trillions chasing AI dreams, Oracle’s become the quiet backbone holding it all up. Whether this is the next big tech revolution or the biggest bubble ever, one thing’s clear, Larry Ellison’s playing the long game, and for now, he’s winning. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - $100 Billion In 1 Day 0:50 - The Deal 5:50 - The Rivalry 8:59 - The Pivot Resources: https://pastebin.com/ieq8UjXY

YTDov8seGrk | 10 Oct 2025

Nvidia just made one of the biggest bets in tech history: $500 billion over four years to build “AI Factories.” These aren’t normal data centers. Instead of handling thousands of workloads, they’ll exist purely to produce one thing: tokens, the core fuel of large language models like ChatGPT and Claude. Imagine a factory that takes in electricity and spits out intelligence. That’s Nvidia’s vision. But massive spending doesn’t come without risk. The last time a company went all-in on infrastructure like this, it was Intel, and that didn’t end well. The parallels are eerie: overconfidence, exploding demand projections, and the assumption that a boom never ends. Meanwhile, Amazon, Google, and Microsoft are building their own AI chips to cut Nvidia out entirely. And regulators from the US to the EU are circling. Nvidia may dominate now, but half a trillion dollars can turn fast from a power move to a cautionary tale. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - A $500 Billion Bet 0:27 - AI Factories? 4:27 - Building In A Bubble 9:34 - Fault Lines In The Plan Resources: https://pastebin.com/BmNNQ9z9

meg89ToDgXo | 06 Oct 2025

Companies like Tesla, Klarna, IBM, and Duolingo all thought they could replace humans with machines. They bragged about efficiency, profits, and “AI-first” futures. But when the robots actually took over, everything started to fall apart. Tesla’s fully automated factory nearly bankrupted the company until Elon scrapped the robots and brought humans back. Klarna’s AI customer service cut thousands of jobs, but tanked quality so badly that they had to rehire. IBM’s HR bot couldn’t handle nuance and failed in real situations. Even Duolingo’s “AI-first” experiment backfired with users calling its new lessons “soulless.” Across industries, companies learned the same lesson: automation isn’t just fragile, it’s dumb without people to adapt when things break. Humans aren’t just workers—they’re the shock absorbers that keep everything from collapsing when the system fails. Turns out, Elon was right. Humans are underrated. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - AI First Future 0:28 - The Machine That Builds The Machine 5:32 - The Dream Of Automation 10:20 - Back-Peddling Resources: https://pastebin.com/RwLJwWeR

MNR0fr8FP68 | 03 Oct 2025

Intel used to be the godfather of chips, the company behind the processors powering most of the world’s computers. But in 2025, things took a turn that no one expected. The US government suddenly announced it had taken a 10% stake in Intel. No cash deal, no normal transaction — just a conversion of CHIPS Act grants into equity. Overnight, Washington became one of Intel’s largest shareholders, and investors were furious. The move raised bigger questions: why Intel and not NVIDIA, Apple, or Meta? Why would Trump use a law passed under Biden to pull it off? The answer lies in the Foundry War. Intel had fallen badly behind Taiwan’s TSMC, which controls over 70% of global chip manufacturing, while China has been pouring billions into its own semiconductor champions. Intel, once dominant, was bleeding cash, but still the only US company positioned to compete in manufacturing. That made them the obvious bet, even if it meant angering shareholders. This strange 10% stake says a lot about how far the US is willing to go to keep chips at home, and why semiconductors have become the new oil. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Intel Gets Bailed Out 0:34 - Bring it Home 3:29 - The Foundry War 8:18 - Shares of Power Resources: https://pastebin.com/wR9QU2PC

CgNLFAb6IlE | 27 Sep 2025

Figma went from underdog to one of the biggest stories in tech. It started as a lightweight design tool that felt refreshingly different from Adobe’s bloated lineup, and creatives flocked to it for the speed, simplicity, and generous free tier. Then everything changed when Adobe tried to buy them out for $20 billion. Regulators stepped in, the deal collapsed, and Adobe had to hand over a $1 billion breakup fee. That single twist gave Figma three times the funding it had ever raised and turned it into a serious challenger. With that war chest, Figma doubled down. They expanded their product lineup, secured 95% of the Fortune 500, and actually became profitable—something rare in Silicon Valley. By 2025, they pulled off the year’s largest IPO, opening at $85 a share and briefly soaring past a $60 billion valuation. The hype has cooled since, but Figma’s rise is proof that a focused startup can stand up to giants, reshape an industry, and maybe even set the standard for the next era of creative software. Timestamps: 0:00 - Figma’s $60 Billion IPO 0:39 - The Monopoly 5:47 - Figma, The Underdog 9:20 - The Comeback Resources: https://pastebin.com/N4T6t3Re

CdMvlz8n-kM | 22 Sep 2025

Start browsing securely from anywhere! Use my link to check out Proton Pass for a safer, faster, and more open internet! ➡️ http://proton.me/pass/logicallyanswered July 2025, GM’s leaders are facing the music. After pouring billions into EV factories, they’ve racked up $130 billion in debt while falling way short of their goals. Ford is cutting production, Musk is pivoting away, and now investors are asking the obvious question: if Tesla can’t make EVs truly profitable, how can GM? The story goes back to Mary Barra’s bold bet to skip hybrids and go all-in on electric. For a while, it looked like a smart play—Tesla was booming, GM stock soared, and confidence was sky high. But the Ultium platform stumbled, production bottlenecks mounted, and sales lagged. Meanwhile, hybrids quietly exploded in popularity, leaving GM backpedaling into a strategy they once dismissed. Now, they’re shifting gears again, adding hybrids to their lineup, trying to stabilize with dividends and buybacks, and hoping investors buy into the new plan. It’s a reminder of how quickly hype can turn to headwinds, and how even the biggest automakers can find themselves chasing a future that doesn’t arrive on time. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - $130 Billion EV Disaster 0:57 - Betting The House 5:21 - Hype To Headwinds 12:46 - U-Turning Resources: https://pastebin.com/9dL9KmpJ Disclosure: This video is sponsored by Proton. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

tDVeGbGaRdE | 19 Sep 2025

Jack Ma was once the face of China’s rise. A former English teacher who built Alibaba into the crown jewel of Chinese tech, rivaling Amazon and reshaping global commerce. By 2020, he was preparing to launch Ant Group, a fintech giant running Alipay with over a billion users, in what would’ve been the biggest IPO in history. But everything changed after one speech. At Shanghai’s Bund Finance Summit, Ma criticized China’s banking system as outdated and risk-averse. Regulators were furious. Within days, Ant’s IPO was canceled. Soon after, Ma disappeared from public view. What followed was a sweeping crackdown. Alibaba was fined billions, Ant was forced to restructure, and Alipay was broken apart. Foreign investors fled, growth slowed, and youth unemployment surged. Now, in 2025, Jack Ma has suddenly returned. Xi Jinping personally invited him to a summit in Beijing, signaling desperation to revive confidence. But after everything, the question remains: why now? LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Losing $900 Billion 0:35 - The Fated Speech 3:15 - The Jewel Of China 7:18 - The Fall Resources: https://pastebin.com/DvrPHCX6

0n3uG8FrO1A | 15 Sep 2025

#ToyotaPartner #ad Learn more about Toyota’s approach to electrification: https://www.toyota.com/humantech/anxiety/ https://www.toyota.com/humantech/outlast/ This video is part of a paid partnership with Toyota. It’s not a vehicle endorsement, but a look at the broader strategy and philosophy behind Toyota’s approach to electrification — including hybrids, EVs, and hydrogen. Toyota believes tech should amplify everyday life, not complicate it — and this story reflects how that philosophy has shaped their decisions over time. Timestamps: 0:00 - Was Toyota Right About EVs? 0:24 - The Original Clean Car 4:26 - The EV Gold Rush 7:58 - A Measured Approach 10:56 - Slow & Steady Wins The Race Resources: https://pastebin.com/bThbAsLJ

3xc6puBoajM | 12 Sep 2025

Warp is free to try but for a limited, my friends at Warp are offering their Warp Pro plan for only $5. Use code LOGICALLY to redeem here: https://go.warp.dev/logically Fiverr was once the go-to place for freelancers. From voice-overs to coding to graphic design, it seemed unstoppable, and investors valued it at over $11 billion. Then it collapsed. Its stock has fallen more than 90%, erasing nearly $10 billion. What went wrong? This is the story of how Fiverr rose on the back of a pandemic-fueled boom, then imploded under its own weight. As the world locked down, demand for digital services exploded. Companies raced online, laid-off workers turned to freelancing, and Fiverr became a lifeline. Revenue skyrocketed, shares soared from $25 to over $200, and leadership doubled down with massive marketing campaigns, pricey acquisitions, and Super Bowl ads. But when the world reopened, growth slowed, losses mounted, and the spending spree caught up. Sellers revolted as algorithms shifted, hidden fees sparked lawsuits, and tone-deaf ad campaigns backfired. Even their big AI pivot only fueled backlash from the freelancers they relied on. Fiverr chased growth at all costs, only to watch it all come crashing down. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Fiverr Crashes $10 Billion 0:31 - Work From Home Boom 3:28 - Big Demand, Bigger Spending 9:02 - Tone Deaf Resources: https://pastebin.com/wJN59s9s Disclosure: This video is sponsored by Warp. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

1PWokZuM-zg | 08 Sep 2025

Try Mobbin for free and get 20% off your 1st year 👉🏻 http://mobbin.com/logicallyanswered Nothing came out of nowhere and instantly became the “cool” phone brand. A glass-back design with 900 LEDs, a clean minimalist OS, and a price tag at half of an iPhone made people believe it was the iPhone of Androids. 100,000 orders rolled in within 24 hours, fans hyped it up, and Carl Pei—the founder who once made OnePlus a success—seemed to have nailed it again. But hype only lasts so long. By the time the Nothing Phone 3 arrived, everything that made the brand different started to feel like a gimmick. The LEDs got swapped for a weird “glyph matrix,” the price jumped into iPhone territory, and the specs didn’t match the premium cost. At the same time, Nothing tried rolling out half-baked features like Nothing Chats, which claimed end-to-end encryption but leaked messages in plain text. Even “Essential Space,” a supposedly built-in feature, looked more like a hidden subscription service. The company went from symbolizing minimalism and rebellion to edging toward Apple’s same walled-garden playbook. On paper, sales and revenue are still growing fast, but fans are asking: did Nothing lose the very thing that made it stand out? LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - The Nothing Phone 0:28 - From Nothing To “Nothing” 4:49 - Same Brand. New Price. 10:48 - Features No One Asked For Resources: https://pastebin.com/8k1vLvju Disclosure: This video is sponsored by Mobbin. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

7_lZEsSlsVc | 05 Sep 2025

Warp is free to try but for a limited, my friends at Warp are offering their Warp Pro plan for only $5. Use code LOGICALLY to redeem here: https://go.warp.dev/logically Amazon went from two decades of razor-thin margins and endless reinvestment to becoming one of the most profitable companies on the planet. Bezos’ playbook was simple: sacrifice short-term returns to build scale, dominate industries, and let competitors’ margins become his opportunity. Instead of raising billions through equity like Google or Meta, Amazon stayed lean, relying on debt and reinvested profits. The turning point came with AWS, the secret engine that quietly made more profit than Amazon’s entire retail business combined. That cushion let Bezos fund aggressive expansion into everything from logistics to entertainment, while delaying profits until the time was right. When Andy Jassy, the architect of AWS, took over as CEO, he flipped the switch. Amazon cut costs, raised prices, leaned on its absurdly profitable cloud and ad divisions, and finally turned the knob from growth to profit. In just four years, the company swung from losing billions to making $85 billion annually. Bezos wasn’t chasing quarterly numbers—he was building long-term domination, and now we’re living in the world it created. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Amazon’s Insane Run 0:55 - Reinvest Everything 5:52 - The Secret Weapon 11:47 - Cashing Out Resources: https://pastebin.com/7HSfcUMD Disclosure: This video is sponsored by Warp. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

qI0bzA35dOE | 01 Sep 2025

WeChat has 1.3 billion monthly users and does basically everything. Messaging, payments, travel tickets, social media, food delivery—you name it, it’s in there. It’s the dream setup for tech companies: one app, all the users, all the money. So why can’t the US or Europe pull this off? Companies have tried. Facebook wanted Messenger to be more than chat. Elon Musk is turning X into a “super app” with payments and even a debit card. Uber folded in food delivery, travel, and payments. PayPal literally called theirs the “Super App.” Yet nothing sticks. Cultural differences, privacy concerns, tight regulations, and people’s obsession with individual choice all get in the way. Meanwhile, Amazon might have quietly pulled it off without anyone noticing. Shopping, streaming, healthcare, payments, groceries—it’s all under their umbrella, just not crammed into one app. Maybe the West will get a true SuperApp someday… or maybe people just don’t want one. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - WeChat 0:28 - The Dream 4:33 - The Barriers 8:49 - The Reality Resources: https://pastebin.com/kKDRP077

PvbP-jKfAzQ | 29 Aug 2025

📱Build your first mobile app in minutes. Check out Emergent and get Pro mode today 👉🏻 https://app.emergent.sh/?via=logicallyanswered ByteDance, the $300 billion company behind TikTok, is stuck in a mess of its own making. They can’t IPO, can’t sell TikTok, and are trapped between U.S. regulators and Beijing’s iron grip. It wasn’t always like this. From meme apps like Neihan Duanzi to news giant TouTiao to TikTok itself, ByteDance grew on the back of one thing: its freakishly good recommendation algorithm. But that algorithm is now at the center of a global tug-of-war. The U.S. says TikTok has to be sold. China says the algorithm can’t leave. And Beijing even holds a “golden share” in the company with veto power over major decisions. Meanwhile, ByteDance makes most of its money in China, keeps growing like crazy, and has found a strange workaround: skipping the IPO entirely by buying back its own shares at sky-high valuations. It’s basically a DIY IPO, one that keeps investors happy while ByteDance stays private, powerful, and impossible to ignore. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - TikTok’s $300 Billion IPO 0:30 - Unwanted Attention 5:04 - Rock And A Hard Place 9:12 - DIY IPO Resources: https://pastebin.com/Rg1JyZXH Disclosure: This video is sponsored by Emergent. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

nKPYiA1ifbw | 25 Aug 2025

YouTube Music has 125 million paying subscribers, yet almost no one seems to use it. Most of those subscribers aren’t choosing it for music at all—it’s bundled inside YouTube Premium, which people buy for ad-free videos. And when we look at actual music streaming, Spotify dominates with over 263 million paying users, while Apple Music and even Amazon Music beat YouTube Music on quality, features, and loyalty. Despite Google’s massive reach, YouTube Music feels like an afterthought: cluttered recommendations, weak audio quality, slow feature rollouts, and zero emotional pull. People already use YouTube for music mixes, but when it comes to serious music streaming, they reach for Spotify or Apple Music out of habit and trust. It’s the same old Google story: big numbers on paper, low real adoption. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - The State Of YouTube Music 0:26 - The Subscriber Mirage 2:42 - Google’s Adoption Curse 7:10 - The Hidden Cost Resources: https://pastebin.com/BPzS2GzY

ClCzFcPnkNw | 22 Aug 2025

Boost Speed, Cut Costs — Get Tidy Today! Try CleanMyMac free for 7 days and use my code LOGICALLY for 20% off https://clnmy.com/LogicallyAnswered Apple just lost nearly $1 trillion in market value in six months, iPhone sales are slipping across the US, Europe, and China, and for the first time in decades people are asking if Apple is losing its edge. Funny enough, the story looks eerily similar to IBM in the 80s: total dominance, record profits, then a slow collapse as competitors caught up and the moat vanished. Apple’s still huge, but growth is stalling, market share is falling, and even its “premium” status is taking hits in places like China. Hardware’s struggling, services can’t fully escape the hardware lock-in, and rivals like Microsoft and Google are eating away at the future with AI and platform-agnostic ecosystems. The question now isn’t whether Apple dies tomorrow, but whether this is the start of a decades-long decline, just like IBM. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Apple Loses $1 Trillion 0:32 - Empire With No Moat 4:15 - The State Of Apple 9:00 - The Apple Ecosystem Resources: https://pastebin.com/xL2z1AUF Disclosure: This video is sponsored by CleanMyMac. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

eB4r0pbcsEU | 18 Aug 2025

Start browsing securely from anywhere! Check out Proton Pass for a safer, faster, and more open internet using my link ➡️ http://proton.me/pass/logicallyanswered Kickstarter once felt like the future. Back in the early 2010s, it was everywhere—wild inventions going viral, millions raised overnight, and headlines calling it the new way to launch a business. It lowered the barrier for anyone with an idea to raise money, build a prototype, and turn it into a product. But the dream started to crumble. Projects like the Coolest Cooler, which raised over $13 million, ended with thousands of backers left empty-handed. Drones that didn’t fly, 3D printers that never shipped, and consoles that failed—Kickstarter became infamous for overpromising and underdelivering. The real problem wasn’t just failed ideas, but the outright scams that slipped through, leaving backers with nothing while Kickstarter still took its 5% cut. Over time, trust eroded. By the late 2010s, growth had stalled, and even the pandemic bump couldn’t save it. Kickstarter isn’t gone, but its golden age is over, and its name is slowly becoming a cautionary tale. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - The Fall Of Kickstarter 2:15 - The Crowdfunding Boom 8:49 - The Scam Spiral The Decline Resources: https://pastebin.com/YjF0wFEn Disclosure: This video is sponsored by Proton Pass. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

JDTF9YaFr8A | 15 Aug 2025

🚀 Check out Lovable and use code LOGICALLYANSWERED for 20% off your first plan ➡️ https://lovable.dev/logically (code is valid until September 15, 2025)! SoftBank was once the king of tech investing. Backed by Masayoshi Son’s wild instincts, they turned a $20M Alibaba bet into over $100B, got in early on Uber, NVIDIA, and even OpenAI, and built the $100B Vision Fund to back “the most ambitious entrepreneurs.” At their peak, Son was the richest man in Japan and hailed as a visionary. But his high-risk style would backfire spectacularly. He sold NVIDIA right before the AI boom, poured billions into WeWork after a 12-minute tour, and backed startups that burned through cash with little to show. The pandemic crushed already struggling investments, the Vision Fund lost tens of billions, and Son’s sequel fund couldn’t even raise outside money. Coupang’s IPO brought a glimmer of hope, but it wasn’t enough to offset massive losses. Once celebrated for having “the smell” for winners, Son is now seen as reckless — and SoftBank’s fall from grace is one of the most dramatic in tech history. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - $100 Billion Implosion 0:23 - High Hopes 3:54 - The First Miscalculation 10:22 - From Bad To Worse Resources: https://pastebin.com/W0tqCNHi Disclosure: This video is sponsored by Lovable. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

R7H6cl3CHYY | 08 Aug 2025

Thanks to Storyblocks for sponsoring this video! Download unlimited stock media at one set price with Storyblocks ➡️ https://storyblocks.com/LogicallyAnswered Klarna seemed unstoppable. The Swedish fintech giant raised billions, partnered with hundreds of thousands of merchants, and became the face of the buy now, pay later (BNPL) revolution. From small purchases like a Costco hotdog to high-end electronics, Klarna made it possible to split payments over time—interest free. On the surface, it looked like a win-win. But under the hood, Klarna's business model relies on something darker: everyday debt. It encourages spending on things you might not be able to afford, especially among financially vulnerable users. And while they lure customers in with ease of use and slick branding, Klarna profits when you fall behind. Late fees, stacked debts, and sky-high interest rates on long-term financing have become key revenue streams. But there's a twist—Klarna itself is drowning in debt. Its operating losses are climbing, credit defaults are rising, and its IPO plans were quietly shelved. So how did a company built on smooth payments end up in its own financial trap? This video explores the rise and fall of Klarna, and what it says about the future of consumer finance. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Buy Now, Pay Later 0:31 - The "BNPL" Boom 4:45 - Laying The Debt Trap 10:17 - Caught In Their Own Trap Resources: https://pastebin.com/VD2EKxch Disclosure: This video is sponsored by Storyblocks. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

CWLjQoXt1NI | 01 Aug 2025

In 2021, Rivian’s valuation hit a staggering $127 billion, briefly surpassing Volkswagen. But the EV bubble didn’t last. Within six months of their IPO, Rivian lost $100 billion in market cap. Despite losing billions every year, Rivian isn’t heading for bankruptcy like many expected. In fact, they might be the EV start-up that survives. This video dives into Rivian’s journey, from RJ Scaringe’s pivot away from flashy sports cars to building adventure-focused trucks that earned them a cult following. We’ll explore their early missteps, the infamous price hike backlash, and how they’ve clawed their way toward profitability by streamlining production and securing key partnerships. While giants like Ford and Volkswagen are pulling back, Rivian is quietly improving, turning losses per car into actual profits. With strong customer loyalty, a new $45,000 R2 model, and a $5.8 billion partnership with Volkswagen, Rivian is no longer the overhyped start-up on the brink—it’s becoming a real contender in the EV market, one small win at a time. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Rivian Loses $100 Billion 0:31 - The Origin Story 5:19 - The Crash 9:51 - Light At The End Of The Tunnel Resources: https://pastebin.com/sgNVEtUj

KN_cUJ0uj5g | 28 Jul 2025

🚀 Check out Lovable and use code LOGIC20YT for 20% off your first plan ➡️ https://lovable.dev/logically (code is valid until August 28, 2025)! Walmart now makes more money than Microsoft, Meta, and Nvidia combined. They're the biggest company on earth by revenue, but they sell groceries. Low-margin, slow-growth, old-school retail. So how did their stock nearly double in 2023? And why are investors treating them like a tech company? For most of its history, Walmart's share price barely moved. Then came a subtle but massive pivot. As the hype around e-commerce plateaued, people rediscovered the value of in-person shopping—and Walmart leaned in. They launched Walmart+, built a data-rich mobile payment system, and transformed their stores into mini ad networks. With over 10,000 locations and massive foot traffic, their ad business—Walmart Connect—quietly became a goldmine. But whether they’re the next Amazon or just got ahead of themselves is still an open question. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - The Insane Economics Of Walmart 0:37 - The Sleeping Giant Wakes 3:59 - Retail To Tech Stock 9:45 - To The Moon, But Not Much Further Resources: https://pastebin.com/GaZHJFJE Disclosure: This video is sponsored by Lovable. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

EEfBxd8Mt5k | 25 Jul 2025

Start browsing securely from anywhere! Check out Proton Pass for a safer, faster, and more open internet using my link ➡️ http://proton.me/pass/logicallyanswered Craigslist is one of the weirdest success stories in tech. It’s the 26th most visited site in the US and still cracks the global top 100, yet it looks like a time capsule from 1999. No endless ads, no engagement hacks, no “growth at all costs.” Just a brutally simple site that works. It all started with Craig Newmark, a self-described “nerd patient zero,” who turned a simple email list into a billion-dollar company without ever selling out. Unlike the typical Silicon Valley founder, Craig wasn’t chasing investors or an IPO — he was solving real problems and letting users shape the platform. This stubborn approach created one of the most trusted communities on the web, but it also attracted trouble. When eBay bought a stake in the company and tried to push Craigslist toward heavy monetization, Craig and his CEO Jim Buckmaster fought back hard, protecting their users at every step. Even today, Craigslist is proof that you don’t have to follow the Silicon Valley playbook to win. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - The Startup That Never Sold Out 0:42 - Regular Old Craig 5:25 - Pull Of Enshittification 12:31 - The Modern Craigslist Resources: https://pastebin.com/E2XhBvJ4 Disclosure: This video is sponsored by Proton Pass. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

4H0x8kYDNJU | 21 Jul 2025

🔒Remove your personal information from the web at https://www.joindeleteme.com/LOGICALLY and use code LOGICALLY for 20% off 🙌 DeleteMe international Plans: https://international.joindeleteme.com Vroom was supposed to fix everything people hated about buying cars. No more pushy dealerships, no more scams, no more stress—just click a few buttons and have your next ride delivered to your door. And for a while, it looked like they nailed it. They raised hundreds of millions, sold tens of thousands of cars, hit a market cap of $8 billion, and went public during the 2020 pandemic boom. But behind the scenes, things were already falling apart. Vroom was burning cash, racking up debt, and promising things they couldn’t deliver—literally. Cars arrived late, broken, or not at all. Customers couldn’t register their vehicles, and the company got slammed with lawsuits and government investigations. As interest rates climbed and the market cooled, Vroom’s massive inventory became a liability they couldn’t escape. In the end, the very growth that made them a Wall Street darling was what destroyed them. This is the story of how Vroom exploded—then crashed just as fast. Timestamps: 0:00 - Vroom To Doom 0:16 - Vroom Explodes 4:01 - Market Collapse 11:18 - Bad To Worse Resources: https://pastebin.com/kzAmYzHX Disclosure: This video is sponsored by DeleteMe. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

ibWAMsRGiK0 | 18 Jul 2025

Airbnb used to be the affordable, easy way to travel. Now it feels like a scam. You book a place for hundreds of dollars, get hit with a $100 cleaning fee, and then they ask you to do the chores. Guests are fed up, and it’s showing—Airbnb’s income dropped 40% in Q1 2025, bookings are slowing, and investors are losing confidence. Meanwhile, hotels are quietly making a comeback. No hidden fees, no chores, just clean rooms and fresh towels. In this video, we break down how Airbnb went from disruptor to disappointment. From rising prices and overbearing hosts to weird new features like "experiences" and "services," we take a look at where Airbnb went wrong, how hotels are bouncing back, and whether Airbnb can fix the mess it created. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - The State Of Airbnb 0:52 - The Outlier That Won 4:50 - Hidden Pain Points 8:55 - Rebound…From Hotels Resources: https://pastebin.com/KffPCrm8

ZMXWUz1Hp3g | 14 Jul 2025

Walgreens was once a titan in American retail. But after reaching over $100 billion in market cap, the company has lost more than 90% of its value and is now shutting down 1200 stores. This isn’t just one company’s collapse—it’s a warning sign for the entire pharmacy industry. While Walgreens doubled down on retail, CVS quietly transformed into something else entirely: a pharmacy, health insurer, and the largest PBM in the U.S. That single pivot may have saved them. Meanwhile, mail-order medication, rising theft, and razor-thin margins are making it impossible for Walgreens—and others like it—to stay profitable. Closures are accelerating, leaving behind pharmacy deserts that disproportionately hurt low-income communities. This is a story about missteps, market forces, and a healthcare industry being pulled in every direction. CVS became the ecosystem. Walgreens got stuck as the storefront. And now the consequences are unfolding across the country. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - The Dire State Of Walgreens 0:34 - Two Different Giants 3:46 - The Ecosystem 9:55 - Hit From All Sides Resources: https://pastebin.com/aeDsDXjZ

Pb5T_pF2l34 | 11 Jul 2025

Start learning for free with TryHackMe! If you want to go premium, use my code LOGIC for 25% off the annual plan. Check it out ➡️ https://www.tryhackme.com/logically Apple just lost one of the most important lawsuits in its history — and it’s going to cost them billions. But the real twist? It was against Epic Games, the makers of Fortnite. What started as a simple payment button turned into a 5-year legal war over Apple’s grip on the App Store… and Apple just lost. But that’s not even their biggest problem. Since December, Apple’s stock has dropped nearly $1 trillion. Their dominance is slipping, not just in court, but in China, their most critical market. With iPhone sales plummeting, rising labor costs, tariffs under Trump, and massive supply chain risks, Apple’s entire empire is under threat. Even their pivot to India may not be fast enough to save them. From malicious compliance to international chaos, this is the story of how Apple went from untouchable tech giant… to being at war on all fronts. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Timestamps: 0:00 - Apple Lost 0:44 - The 5-Year Lawsuit 4:30 - Malicious Compliance 10:33 - The Tug Of War Resources: https://pastebin.com/8MAcaE0u

GCP3RJfAiJo | 04 Jul 2025

Doesn’t it feel like Amazon just isn’t good anymore? You search for something simple like a USB dongle and end up scrolling through overpriced, low-quality junk that looks great in photos but barely works when it shows up. What used to be the most convenient shopping platform now feels like a more expensive version of Temu. A big part of the problem? Dropshipping. Random sellers grab dirt-cheap products off Alibaba, mark them up 10x, and flood Amazon with ads to push them to the top of search results. You’re not paying for quality—you’re paying for fees, fake branding, and aggressive ad spend. Somehow, Amazon still wins. Their ad business makes more profit than their actual retail sales. The whole thing’s flipped—it's not about better products, it's about who can game the system hardest. This video explains why Amazon feels off lately. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ Discord: https://discord.gg/SJUNWNt Timestamps: 0:00 - What Happened To Amazon? 0:26 - Promise To Garbage 4:28 - Gold Rush 9:12 - Return To Form Resources: https://pastebin.com/gskhC1Bj

VBjiEAlLgW0 | 30 Jun 2025

Try Rocket Money for free: https://rocketmoney.yt.link/sC8WZ1J After burning through $33.5 billion and losing money for over a decade, Uber has finally posted a real profit. But the path to profitability wasn’t pretty. From slashing driver pay and hiking restaurant fees to steamrolling local governments, Uber’s growth-at-all-costs strategy left a trail of unhappy drivers, frustrated restaurants, and angry regulators in its wake. Even now, Uber’s profitability depends on squeezing its workers and partners, with driver wages falling and delivery fees spiking. And just as Uber hits this long-awaited milestone, one rival—DoorDash—is quietly taking over the food delivery market. With lawsuits piling up, governments pushing back, and investor doubts growing, is Uber’s profit story already under threat? LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ X: https://x.com/jhariharan72 Discord: https://discord.gg/SJUNWNt Timestamps: 0:00 - Uber’s First Profit 0:36 - Growth, Without Profits 4:07 - We Win, Everyone Loses 11:09 - Ill Omens Resources: https://pastebin.com/w92386QF Disclaimer: This video is not a solicitation or personal financial advice. All investing involves risk. Please do your own research. https://www.silomarkets.com/disclosures Disclosure: This video is sponsored by Rocket Money. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

8RgLWhtePYQ | 27 Jun 2025

Earn Interest On Stocks & ETFs: https://www.silomarkets.com/logic For years, Samsung was the global smartphone king—out-selling Apple and dominating markets from Asia to Europe. But things have changed. Sales are slipping, market share is falling, and in 2022, Apple finally took the #1 spot worldwide. What went wrong? It’s not just Apple that’s causing problems. Chinese brands like Xiaomi and Huawei have squeezed Samsung from below, while Apple continues to dominate the premium segment. Samsung’s wide and confusing product lineup, along with its lack of a cohesive ecosystem, left it vulnerable. Meanwhile, the smartphone market itself is shrinking, with the used phone market booming and consumer upgrade cycles slowing down. Even Apple’s now feeling the pressure. In this video, we break down Samsung’s incredible rise, its plateau, and its ongoing decline—and why the battle today isn’t just about selling phones… it’s about keeping customers locked in for life. LinkedIn: https://www.linkedin.com/in/hariharan-jayakumar-silo Instagram: https://www.instagram.com/hariharan.jayakumar/ X: https://x.com/jhariharan72 Discord: https://discord.gg/SJUNWNt Timestamps: 0:00 - Samsung Is Losing 0:26 - The Rise 5:35 - The Plateau 10:09 - The Fall Resources: https://pastebin.com/6izaDwCe Disclaimer: This video is not a solicitation or personal financial advice. All investing involves risk. Please do your own research. https://www.silomarkets.com/disclosures

q2_RY1hUKR4 | 23 Jun 2025

🔓Remove your personal information from the web at https://www.joindeleteme.com/LOGICALLY and use code LOGICALLY for 20% off 🙌🏻 DeleteMe international Plans: https://international.joindeleteme.com On April 30th, 2025, Stellantis—parent company of Dodge, Jeep, Chrysler, and RAM—reported a brutal Q1. Revenue collapsed, profits vanished, the stock is down 70%, and CEO Carlos Tavares just resigned. But what makes this collapse so shocking is that Stellantis was supposed to win. After merging Chrysler and Peugeot in 2021, they became one of the largest automakers in the world. Tavares had a bold plan: reposition iconic American brands like Jeep and Ram as luxury products with higher margins. But it backfired—badly. Sales plummeted, customers were alienated, and dealerships revolted. This video breaks down how one of the greatest brand betrayals in modern auto history happened—from sky-high truck prices and semiconductor shortages to rising interest rates and tariff chaos. Stellantis wanted more profit per car—but lost their customer base instead. Here's how it all went wrong. The World's First Cash Back Investing Platform: https://www.silomarkets.com/logic Free Weekly Newsletter With Insiders: https://logicallyanswered.co/ Socials: https://www.instagram.com/hariharan.jayakumar/ Discord Community: https://discord.gg/SJUNWNt Timestamps: 0:00 - The State Of Stallantis 0:37 - The Perfect Crisis 6:11 - Annoying Your Customers 12:18 - From Bad To Worse Resources: https://pastebin.com/aVVKS3fc Disclaimer: This video is not a solicitation or personal financial advice. All investing involves risk. Please do your own research. https://www.silomarkets.com/disclosures Disclosure: This video is sponsored by DeleteMe. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

jwoaSf47knw | 20 Jun 2025

Start browsing securely from anywhere! Check out Proton Pass for a safer, faster, and more open internet using my link ➡️ http://proton.me/pass/logicallyanswered Temu exploded onto the scene out of nowhere—Super Bowl ads, top of the App Store, and prices so cheap they felt illegal. But now, the shine is fading. Prices are rising, downloads are collapsing, and profits are in freefall. Behind Temu’s meteoric rise was a bold and risky strategy: exploit a little-known legal loophole to avoid U.S. import tariffs and flood the market with rock-bottom prices. It worked—until it didn’t. In this video, we break down how Temu weaponized negative margins, gamified shopping mechanics, and questionable product safety to dominate U.S. e-commerce. But when the U.S. closed the loophole and slapped China with a 145% tariff, Temu’s entire foundation cracked. From dopamine-triggering loyalty programs to dangerously cheap products and an unsustainable burn rate, this is the real story of Temu’s explosive rise—and equally dramatic stumble. Was it always destined to crash? Or is there a path to survival? Let’s find out. The World's First Cash Back Investing Platform: https://www.silomarkets.com/logic Free Weekly Newsletter With Insiders: https://logicallyanswered.co/ Socials: https://www.instagram.com/hariharan.jayakumar/ Discord Community: https://discord.gg/SJUNWNt Timestamps: 0:00 - The State Of Temu 0:37 - The Rise Of Temu 6:11 - Inherent Problems 12:12 - External Problems Resources: https://pastebin.com/PLmEXZT6 Disclaimer: This video is not a solicitation or personal financial advice. All investing involves risk. Please do your own research. https://www.silomarkets.com/disclosures Disclosure: This video is sponsored by Proton Pass. Some of the links in this description may be affiliate links, which means I may earn a small commission at no additional cost to you.

bmK1BbZ0VvU | 16 Jun 2025

The World's First Cash Back Investing Platform: https://www.silomarkets.com/logic Citi was once the biggest bank on Earth. Then it needed nearly half a trillion dollars in bailouts to survive. But behind that collapse lies a brutal story of ego, betrayal, and ambition—between two men who changed banking forever: Sandy Weill and Jamie Dimon. Once mentor and protégé, they became bitter rivals whose falling out helped trigger the financial crisis itself. This isn't just a story about bad loans or risky bets. It's a story about how personal pride, nepotism, and resentment at the top of Wall Street reshaped global finance. From Jamie’s quiet rise to Sandy’s empire-building obsession, to the repeal of Glass-Steagall and the explosion of subprime mortgages, every chapter pushed Citi closer to collapse—while Jamie quietly built a bank that would survive the 2008 crash almost untouched. It’s a story of ambition, betrayal… and two very different visions of what it means to lead. Free Weekly Newsletter With Insiders: https://logicallyanswered.co/ Socials: https://www.instagram.com/hariharan.jayakumar/ Discord Community: https://discord.gg/SJUNWNt Timestamps: 0:00 - Citi Crumbles 0:30 - The Protoge 6:52 - The Betrayal 10:03 - The Reckoning Resources: https://pastebin.com/mwr0xzgE Disclaimer: This video is not a solicitation or personal financial advice. All investing involves risk. Please do your own research. https://www.silomarkets.com/disclosures

DeQSGqfK66Y | 13 Jun 2025